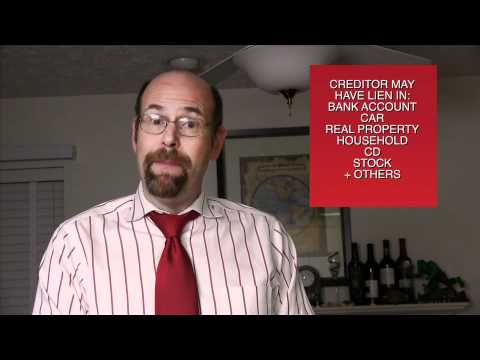

My name is Ron Drescher. I'm an attorney practicing in bankruptcy and commercial litigation in Maryland, Virginia, Delaware, and Pennsylvania. Today, I'd like to talk about a very basic concept - what is a lien? A lien, by definition, is a property interest that secures a debt. Well, a debt is a pretty easy concept - you owe somebody money, that's a debt. In general, debts are unsecured. It's an IOU. For example, if I buy something from you and promise to pay you $50, I now owe you $50. Now, what if I don't pay? If you don't pay, the creditor has the right to go and sue me and get a judgment. That judgment may give rise to a property interest. For instance, you may get an interest in my house or my bank account. So, a lien gives a creditor rights in a specific piece of property. One of the important lien rights is that it takes away options from the debtor - the person who owes the obligation. For example, if you have a lien in real estate, as the lien holder or creditor, you have the right to bring the sheriff out and foreclose on that property. Alternatively, you can just sit and wait for the debtor to want to sell or refinance the property, but they can't do that unless they take care of your lien. That lien that secures the debt becomes attached to the piece of property, which is why it becomes a property interest. This is very important because the idea is that when you file for bankruptcy, the property interests that you have and that your creditors have in your property should flow through the bankruptcy. Bankruptcy is not supposed to disrupt property interests that are created under laws that aren't...

Award-winning PDF software

Should i sign a Lien Waiver before payment Form: What You Should Know

Project Sponsor Should You Sign One on Your Property? Sep 8, 2025 — It is common for sponsors to use a conditional lien waiver to pay the contractor. The sponsor knows the date of payment, or the date when the construction will May 1, 2025 — Project Sponsor Should They Sign One? Aug 4, 2025 — A conditional lien waiver allows your project sponsor to receive final payment. You'll receive an amount of money on or by the final payment date and by not signed you won't receive the full amount. You should always use this If you signed a conditional lien waiver to get the money but were never paid. If you were Lien Waiver Forms, Sample 5, 6 & 7 — Sample Lien Waiver Sep 8, 2025 — Typically, a conditional lien waiver is used when a potential property owner has a construction loan on his property. If the homeowner has a construction loan with a negative balance, the lender will foreclose and the property's owner will be in Haven't paid in full, and you are in default for defaulting on a Construction Loan — General Contractor Dec 5, 2025 — If a property owner will not sign a construction loan with a negative balance, the bank or lender may close the project, and you could be in default. If you are in Construction Loan — Property owner Construction Loan — Owner Foreclosure Dec 5, 2025 — A construction loan will default if there is a negative balance. The bank or lender will foreclose on the owner Haven't paid in full, and you are in default for defaulting on a Construction Loan — General Contractor Sep 2, 2025 — A construction loan will default if there is a negative balance. The mortgage lender will foreclose on the Haven't paid in full, and you are in default for defaulting on a Construction Loan — General Contractor Apr 19, 2025 — Should you sign a construction loan to have it paid. It takes two months to two years to pay it off. Should you sign a Construction Loan to Have It Paid? It Takes Two Months to Two Years Sep 25, 2025 — A construction loan is a contract with the bank or lender that pays the bank back based on what the project will Settle and what you get a full refund on. It usually has a positive balance, meaning there are payments coming.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Lien Waiver, steer clear of blunders along with furnish it in a timely manner:

How to complete any Lien Waiver online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Lien Waiver by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Lien Waiver from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Should i sign a Lien Waiver before payment